foreign gift tax cpa

Gifts from Foreign Nationals Reporting Requirements. This foreign tax credit penalty is also reduced by the amount of the dollar penalty imposed.

Fa La La Falling Afoul Of Foreign Gift Rules Ryan Wetmore P C

In the following situations you need to file a Form 3520 with the IRS.

. The Tax Law Office of David W. For distributions from foreign entities the penalty is equal to the greater of 10000 or 35 of the gross value of the distributions from the foreign entity. Person is required to report the receipt of gifts from a nonresident or foreign estate only if the total amount of gifts from that nonresident or foreign estate is more than 100000 during the tax year.

Beginning January 1 2018 nonresident aliens received the same 15000 gift tax exclusion annually available to citizens and residents. If you received more than a certain threshold amount you must furnish certain. Citizen or resident is required to report a foreign gift that exceeds 16076 adjusted annually for inflation during the year if the gift is from a foreign corporation or foreign partnership.

American expatriates are advised to contact an expat tax CPA if they have questions about gifts tax reporting foreign gifts tax foreign trust foreign partnership foreign controlled corporations and other overseas tax issues. Person that you treat as a gift or bequest. Estate tax that could be due on death.

1 However a US. If it is not reported the US. Providing the support you deserve.

Foreign Gifts Reporting. As a valued client you get a secure password-protected portal. Klasing is a boutique California tax firm comprised of award-winning nationally recognized Tax Attorneys and CPAs.

Receive over 100000 of gift or bequest from foreign individuals or estate. The reporting threshold is increased to 100000 when the gift is from a nonresident alien individual or foreign estate. Form 3520 and 3520-A.

Once the 100000 threshold has been surpassed the recipient must separately identify each giftinheritance that is more than 5000. Form 3520 is an information return for a US. The penalty for failing to file a Form 3520 that should have reported a foreign gift or bequest or for filing an incorrect or incomplete form with respect to a gift or bequest is 5 of the gift or bequest for each month during which the.

Person who received foreign gifts of money or other property you may have to report these gifts on the IRS Form 3520 Annual Return to Report Transactions with foreign Trust and Receipt of Certain Foreign gifts. Person receives a gift from foreign person and the value of gift exceeds either the individual foreign person or entity foreign person threshold the gift must be reported. The gift tax rates start at 18 and increase to a maximum rate of 40.

If you are a US. We help you take charge of your finances to ensure a sound and secure future. Person may be subject to Form 3520 penalties which are usually 25 value of the gift.

Person to report certain transactions with foreign trusts as defined in Internal Revenue Code IRC section 7701 a 31 or to report the receipt of certain foreign gifts or bequests. This annual exclusion began to increase in 2002 and it reached 155000. Foreign Trust and Foreign Gift.

If you own a foreign trust and you are a US person you need to file Form 3520-A annually. For Foreign Gift or Foreign Inheritance Issues. Regarding the latter as of 2019 you will need to file Form 3520 if youre a US.

Receive distribution from a. Gift tax would be due on gifts exceeding the 15000 exclusion amount. Count on us to take the worry leaving you to do what you do best.

It is important to contact international tax experts that can help navigate murky waters of the IRS. Tax Attorney for Domestic and International Tax Issues Serving All of California. For foreign partnerships or corporations the amount in 2022 is.

Receive over 16388 from foreign corporations or partnerships. The GREATER of 10000 35 of the gross value of any property transferred to a foreign trust 35 of the gross value of any property received by a US person from a foreign trust or. Person who receives foreign gifts that exceed certain threshold amounts during the taxable year must report the gifts on a Form 3520.

For gifts from nonresident aliens or individual estates this amount is 100000. 2 days agoFor purposes of federal income tax gross income generally does not include the value of property acquired by gift bequest devise or inheritance. Foreign Gift Reporting.

More specifically Form 3520 is required to be filed in the following four loosely related contexts the first three of which are specified in IRC. Specifically the receipt of a foreign gift of over 100000 triggers a requirement to file a Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. Information Return of a 25.

If you fail to report gifts to or from a foreign trust the penalty is. Tax code increased the gift tax exclusion that you can take every year for a non-citizen spouse to 100000. Person who receives a covered gift or bequest from a covered expatriate who left the United States on or after June 17 2008.

On July 14 1988 the US. Reporting is required if aggregate foreign gifts from a nonresident alien or individual estate and from foreign partnerships or corporations exceeds a certain amount during the given tax year. To make the situation even worse foreign nationals are often under the mistaken belief that by adding the names of their children to the title of the property it will reduce the amount of US.

5 per month up to a maximum penalty of 25 of the 100000 amount of unreported foreign gifts andor unreported foreign inheritances also called foreign bequests for failure to report the gift or inheritancebequest on Form 3520 Part IV. Person other than an organization described in section 501 c and exempt from tax under section 501 a who received large gifts or bequests from a foreign person you may need to complete Part IV of Form 3520 Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts and file the form by the 15th day of the fourth month. At MEDOWS CPA our NYC Certified Public Accountants are well versed in issues pertaining to foreign taxes such as foreign gifts.

Citizen and you received 100000 or more from a nonresident alien individual or foreign estate that you treated as a gift or bequest. 10 reduction shall not exceed the greater of 10000 or the income of the foreign corporation or foreign partnership for the accounting period for which the failure occurs. 3520 Trust Gift Penalties.

You also need to file if you received more than 16388 from foreign corporations or partnerships. A special tax law provision Section 2801 of the Internal Revenue Code was added to the HEART Act and enforces a tax at the highest applicable gift or estate tax rates on any US. If you are a US.

CPA Ted Kleinman has over three decades of experience and knowledge in dealing with IRS tax regulations and he will ensure that your tax needs are. However talking to a CPA that is familiar with the tax laws surrounding gifts from a foreign person will allow you to easier comply with US. Form 3520 is an informational return and not a tax return because foreign gifts are not subject to income tax.

Tax Help we want you to know that you are in good hands. For foreign gifts you may be subject to a penalty equal to 5 but not to exceed 25 of the amount of the foreign gift or bequest for each month for which failure to report continues. A foreign gift is any amount received from a person other than a US.

Form 3520 is due the fourth month following the end of the persons tax year typically April 15.

Planning For A Successful 2021 Tax Season

Gifts From Foreign Persons Marcum Llp Accountants And Advisors

Tax Services For Foreigners 212 Tax Services New York City

Gifts To U S Persons Marcum Llp Accountants And Advisors

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Should You File A Gift Tax Return For 2021

What Is The Purpose Of Estate And Gift Taxation

Gift Tax What Is It How Does It Work Personal Capital

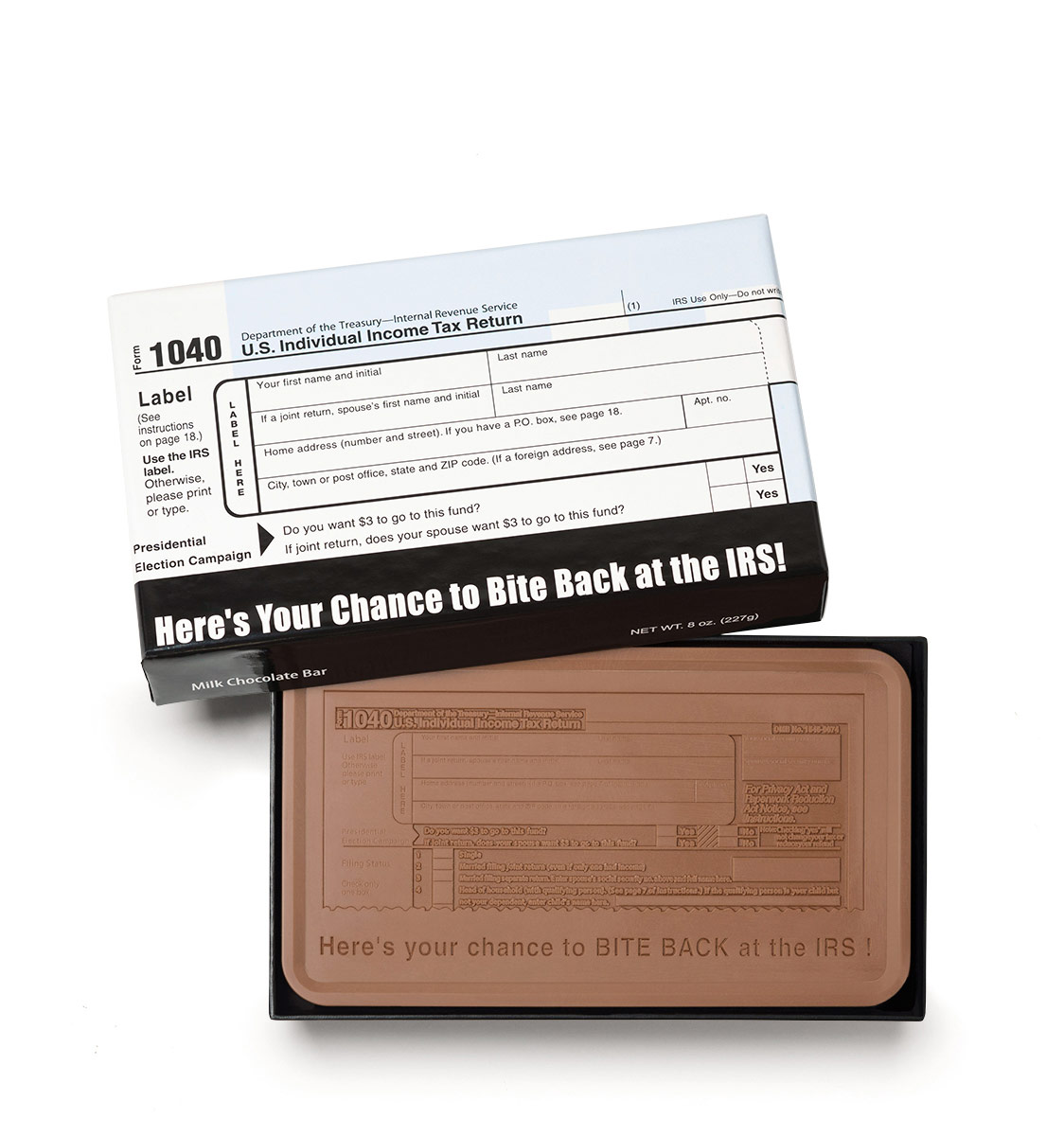

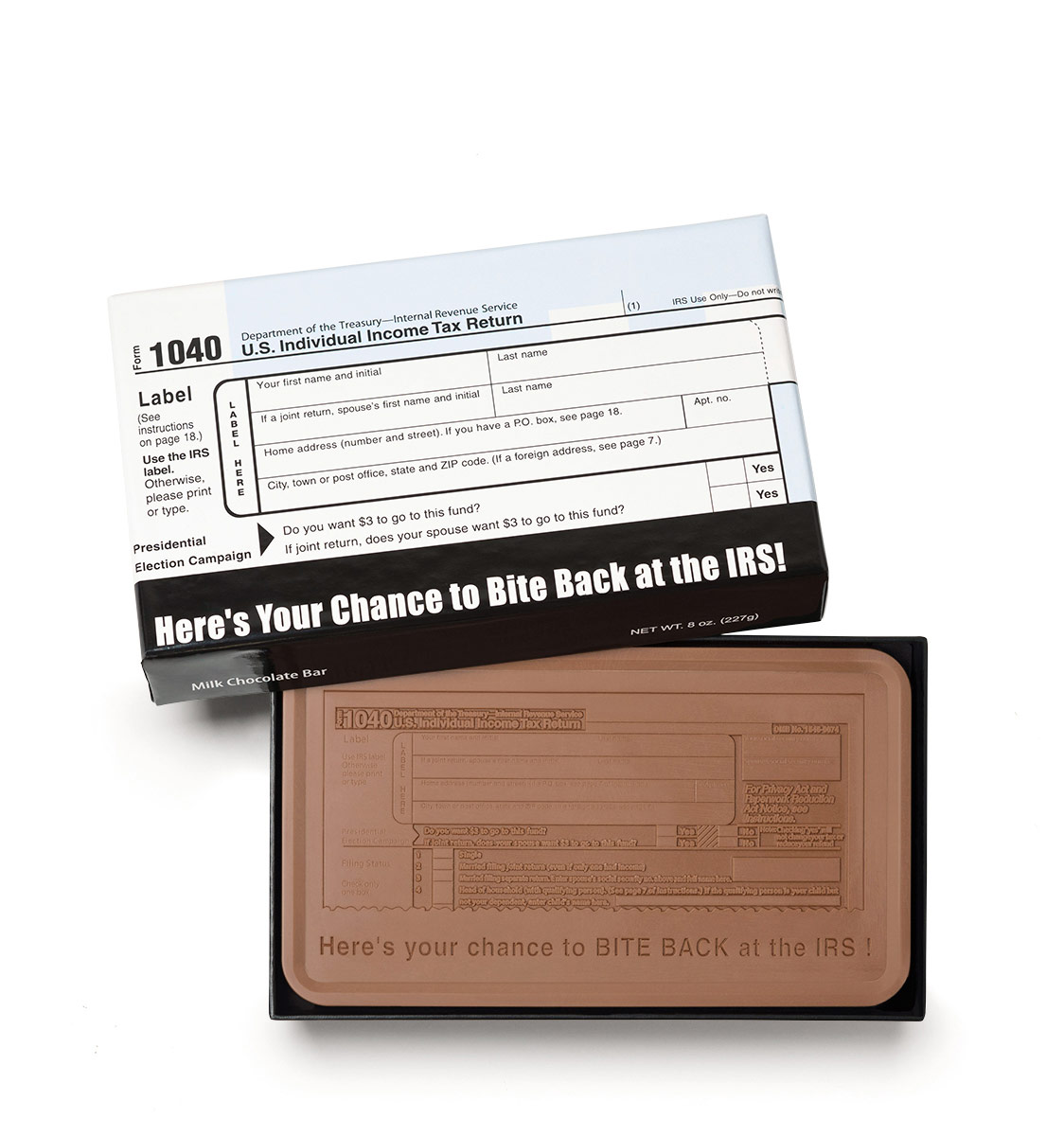

Edible Gift Ideas For Tax Preparer Accounting Clients Totally Chocolate

International Tax Return Preparation Baldwin Accounting Cpa Orlando Florida

Receiving A Foreign Gift You May Need To Tell The Irs The Wolf Group

Irs Allows Digital Signatures For Estate And Gift Tax Returns Cpa Practice Advisor

What You Need To Know About Stock Gift Tax

Taxes Reporting A Foreign Gift Or Bequest Strategic Finance

International Taxation Trans Pacific Accounting Trans Pacific Accounting And Business Consulting Llc

Chaston Tax Accounting Home Facebook

Cpa Exam Simulation Gift Tax Youtube

U S Gift Taxation Of Nonresident Aliens Kerkering Barberio Co Certified Public Accountants Sarasota Fl

Form 3520 What Is It And How To Report Foreign Gift Trust And Inheritance Transactions To Irs Youtube